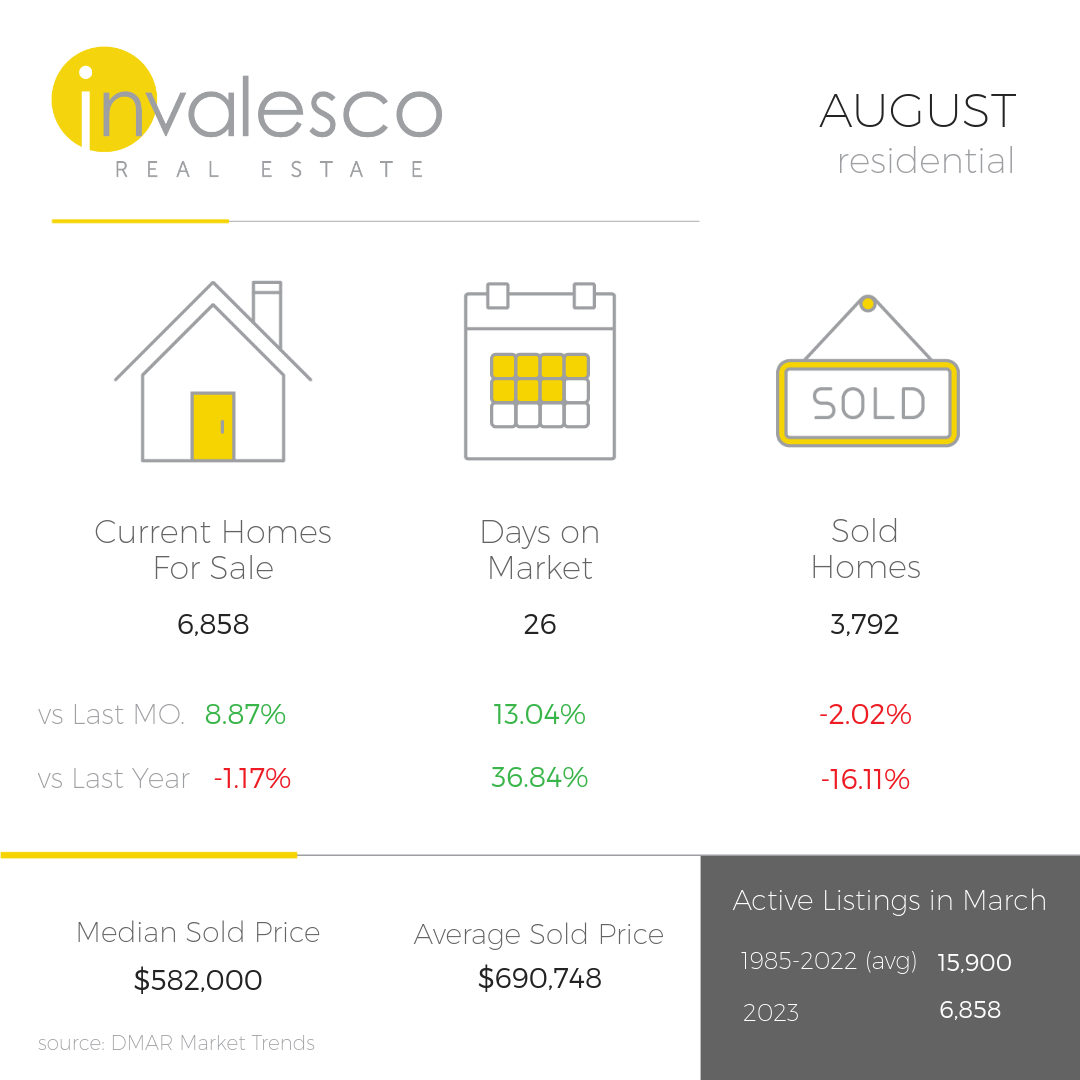

Market Update | August

The Denver real estate market remained slow throughout the month of August, with closed units down 16% and total sales volume down 12% year over year. Though the slowdown can largely be attributed to the combination of high interest rates and high home prices, seasonality is partly to blame as well. We saw a slight increase in inventory this past month, with active listings up almost 9% at month end as compared to July, though year over year inventory remained close to flat. Typically, we see active listings increase only 1.76% from July to August. This year’s month over month increase demonstrates the current underperformance of our market, as it means that new listings are not being absorbed as quickly as they usually are. With inventory slowly growing, however, we are getting closer to a balanced market.

Go Back Though the overall market is slower, home prices were up almost 5% from last year. Homes are sitting on the market for longer; on average 26 days. This average may be skewed by homes that are priced incorrectly, however. While homes that are priced correctly may move more quickly, homes that are not priced correctly end up sitting on the market for upwards of 70 days. Despite the lower year over year sales numbers, Denver still ranks as the fourth-strongest house market in the nation, with many businesses relocating to the state due to our great lifestyle opportunities and talent pool. Filings for Colorado new businesses are up 39% in the second quarter compared to last year as well, meaning demand for homes in our market will remain strong. Furthermore, while interest rates jumped to 7.5% in August, they ended the month at 7%. As rates will likely decrease further in 2024, we expect a flurry of activity from the existing pent-up demand.

Metro Denver’s inflation rate is starting to come down, though not as quickly as it has in other major cities. The Fed communicated this month that it will continue its quest to lower core inflation to 2% and aim for a period of below-trend economic growth. In the meanwhile, investor home purchases fell 45% year over year in the second quarter, outpacing the drop in the overall market. As investors remain more risk averse and many other buyers sit on the sidelines waiting for rates to decline, this may be a great time to purchase.